Our Mission: Empower Do-It-Yourself Investors with Free Academic-based Research & Resources for Life-long Investing

These are among the best financial tools invented in the past 100 years. They could be better.

Reprinted courtesy of MarketWatch.com

Published: August 14, 2025

To read the original article click here

The target-date retirement fund is one of the best financial tools invented in the past 100 years.

- It’s part of almost all employee retirement plans.

- It’s managed by professionals and does not require any decisions from its shareholders.

- Its costs are low.

- It automatically does most of the important things working folks should do so they can afford to retire someday.

Target-date funds are at the heart of today’s discussion, the final article in a series I refer to as Investor Boot Camp 2025.

With such a fund, your retirement investing becomes easy and convenient. Your asset allocation is adjusted automatically. Over the years as your chosen retirement date approaches, the portfolio gradually shifts toward more conservative investments such as bonds, in a “glide path.”

These funds “could enhance retirement wealth by as much as 50% over a 30-year horizon” for people 100% invested in TDFs. That was the conclusion from an academic study of more than a million actual retirement accounts, research performed by Olivia Mitchell of the Wharton School of the University of Pennsylvania and Stephen Utkus of Vanguard Investments.

If you are among the millions of Americans taking advantage of this all-in-one “set it and forget it” portfolio, you are in good hands.

They’re good, but…

However, these funds aren’t perfect. For one thing, most include a small allocation into bonds, even for investors in their 20s.

It might seem comforting to know your fund really does have your back, even with as little as 10% in bonds. But three times during my lifetime, I recall the stock market declining by 50% or more.

In those cases, a 10% stake in bonds would not have helped in any meaningful way. And the rest of the time, which is most of the time, that 10% would have earned less in bonds than in equities.

Worse, this bond allocation robs young investors of the opportunity to buy stocks of great companies at large discounts.

The second major drawback for target-date funds is their lack of equity diversification.

Most target-date funds are based on the S&P 500 or a similar index. Yet all available evidence indicates that over the long haul, adding value stocks and small-cap stocks significantly improves returns without adding significant risk.

Typical target-date funds hold some of those asset classes, but far too little to capture much of their benefit.

Here’s good news: Investors can easily fix that by adding just one additional fund.

Why add small-cap value?

The best booster fund is one that invests in small-cap value stocks. Why is this asset class so powerful, especially for long-term investors?

Watch video: 20 things you should know about small-cap value

Let’s look at some numbers to show what’s possible when you use small- cap value stocks to supercharge a target-date fund.

The numbers come from Chris Pedersen, director of research at The Merriman Financial Education Foundation and author of “Two Funds For Life.”

Chris tracked small- cap value stocks and large-cap blend stocks (very similar to those that make up the S&P 500) for every month from Jan. 1, 1928, through May 31, 2025 (more than 97 years of data) and found the following:

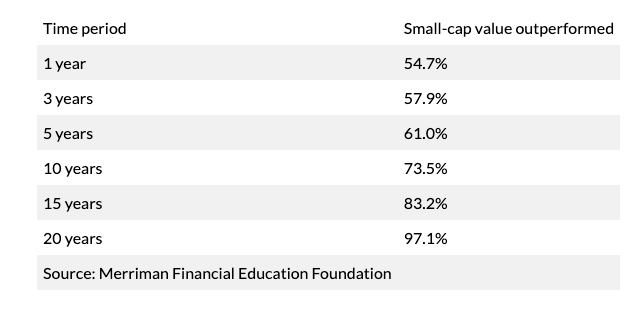

Table 1: Probability of small-cap value stocks outperforming large-cap blend over various periods, 1/1/1928 through 5/31/2025

According to Chris, that means that, going back nearly 100 years, during any random period of three or more years, small-cap value had a better-than-even chance of outperforming large-cap blend.

As you can see, the longer the holding period, the more likely that would have been.

Many investors have an investment horizon of 40 years, especially if they include their retirement years.

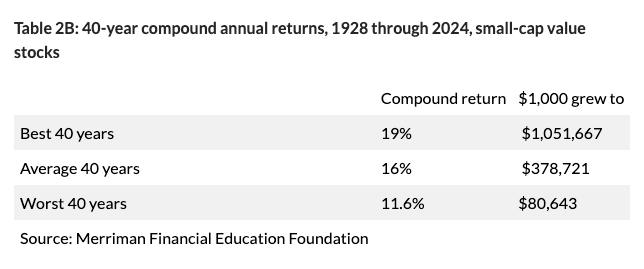

Let’s see what small-cap value stocks might do for them, compared with large-cap blend. The following numbers are based on 58 40-year periods.

To my mind, those numbers make an extremely strong case for using a small-cap value fund to boost long-term investment returns. Doing so is likely to give you more money to spend in retirement and more to leave to your heirs.

How much small-cap value do you add?

If you’re onboard with this idea, then the key question becomes “how much?”

Entire books have been written on that topic. Among them are Chris Pedersen’s book, referenced above, and a book I wrote with Richard Buck, for which you’ll find a link at the end of this article.

Those books are great for investors who want to dig into data and explore numerous options.

But if you like keeping things simple, with most of your money under the comfortable umbrella of a target-date fund, here are three variations worth considering:

First, for a one-size-fits-all plan, no matter your age, you’ll likely improve your outcome if you move 10% of what’s in your target-date fund into a small-cap value fund.

You can do this once with your existing balance, then leave it alone. Or, in addition, route 10% of all your future contributions into small-cap value and the other 90% into the target-date fund.

This could boost your long-term annual compound return by one-half of 1%. That’s a difference you will notice.

Second, if you’re in your 20s or mid-30s, you could reach for greater benefits with 20% in small-cap value instead of 10%. At 40, you could keep that mix or dial back the small-cap value in your future contributions to 10%.

Third, since we’re talking about the really long term, young people might think about harnessing the full power of small-cap value stocks in their early investing years.

The numbers in Tables 2A and 2B suggest some potential outcomes for a 25-year-old who invests $1,000 in a Roth IRA, then leaves it to compound for 40 years.

So here’s my final suggestion: Starting whenever you can, put your entire annual contribution into a small-cap value fund until you’re 30.

Once you’re 30, adopt my first recommendation for all future contributions, using a relatively conservative 90/10 allocation until you retire.

Based on nearly a century of historical data and everything else I know, I believe this third suggestion could dramatically improve your ultimate results.

However, the future is unknown and the market can be full of surprises that sometimes last for decades.

So be enthusiastic – and be prudent. Don’t go overboard.

Read more Investor Boot Camp columns:

These small changes could boost your investment gains by millions of dollars

Why young investors should own stocks — not bonds

Are you ready for a big stock-market drop?

Saving for retirement is easier than you think

How to make sure you don’t run out of money in retirement

The best ways to invest in stock funds

How to retire with more money and greater peace of mind

Richard Buck contributed to this article.

Paul Merriman and Richard Buck are the authors of We’re Talking Millions! 12 Simple Ways to Supercharge Your Retirement.

Delivery Method. Paul Merriman will send stories to MarketWatch editors on a biweekly basis. Licensor may republish such stories 24 hours after publication on MarketWatch with the attribution.