Our Mission: Empower Do-It-Yourself Investors with Free Academic-based Research & Resources for Life-long Investing

Simple ways to supercharge your financial future

Reprinted courtesy of MarketWatch.com

Published: January 4, 2023

To read the original article click here

This past November, I made a 90-minute presentation to about 150 Honor Society engineering students at Rutgers University.

To say that this was an intelligent audience would be an understatement.

These young minds are being trained to use mathematics — rather than hunches and guesses and sales pitches — as they design bridges and buildings and highways and rockets and water systems, and thousands of other things that need to work reliably.

I thought I could get their attention with a presentation called “Follow the Math.” It apparently worked.

- “I honestly never realized how powerful investing can be.” –C.S., freshman

In their feedback, a number of students mentioned a favorite quotation I shared from Warren Buffett: “You only have to do a very few things right in your life so long as you don’t do too many things wrong.”

I showed them some simple ways they can “supercharge” their financial futures.

You probably already know most, if not all, the things I told them. There’s nothing magic here, no secrets. Just the result of good sense, careful study, lots of experience — and MATH!

These students liked what they heard.

- “The simpler you can make it, the higher the probability of success. Just follow the math!” –K.D., freshman

- “Follow the math! I will implement this in my life from now on.” –N.L., junior

I started by showing the power over a lifetime of achieving an extra investment return of “only” 0.5% a year. And of an extra 1% a year. I showed them a simple investment scenario in which an extra 0.5% increased the lifetime benefit by 28%. An extra 1% return boosted that benefit by 64%. It’s just math.

Like almost all young people I talk to, these students were quite surprised by the enormous benefit of starting to invest earlier vs. later.

I outlined this interesting scenario: On the day you are born, your parents set aside $1, then add another $1 every day until you’re 20. Then you take it over from there by adding $1 every day until you’re 70.

That mere $365 a year, assuming it earns 10%, grows to $2.9 million. It’s just math.

But what if you aren’t lucky enough to have parents who did this for you? You can start that $1 per day savings when you’re 20, and at age 70 you will have $425,000.

I could almost see their mathematical brains at work as they realized that difference — nearly $2.5 million — came entirely from those first 20 years.

- “The statistics on saving $1 a day are amazing. I will definitely start saving money now.” –S.J., freshman

What I showed them was pure math — mixed with a bit of magic — the magic of time.

I quickly followed up with a scenario they can put to work: a mathematical comparison of starting to invest at age 25 vs. age 30.

Again, the numbers were startling:

Scenario 1 calls for investing $6,000 a year when you’re 25, then increasing that amount by 3% every year until you’re 65. Assuming a 9% compound investment return, your total savings of $452,408 grow to $3.07 million when you’re 65.

In Scenario 2, you do exactly the same, but don’t start until you’re 30. That means you put in a total of $362,772, which grows to $1.92 million at age 65.

These students quickly figured out that those first five years eventually became worth an extra $1.15 million.

By this point in the presentation I was pretty sure that I had their full attention. Their feedback confirmed it.

- “I will finally get a bank account so I can begin saving.” –C.D., junior

- “I will definitely start investing more right now … and take advantage of this time in my life.” –R.K., senior

Now it was time to tell them some easy ways to get at least an extra 1% in expected lifetime investment returns.

1. They can expect higher long-term returns from stocks than from bonds. Since 1928, stocks have compounded at 10%, vs. 5% for bonds.

2. They are much more likely to succeed if they own many stocks rather than only a handful.

3. Their returns will be higher if their expenses are lower. (They grasped this point immediately.)

4. They can accomplish those last two things, owning more stocks and paying lower expenses, in a single step by investing in index funds.

5. I introduced them to diversification and the benefits from “supercharging” what might otherwise be a bland portfolio by diversifying into small-cap stocks and value stocks.

These students all have the potential for at least 40 years of investment returns. So I showed them some interesting numbers from the past.

Here’s one simple comparison:

- In the average 40-year period from 1928 through 2021, the S&P 500 index SPX, +0.75% compounded at 11%; $100 grew to $6,499.

- An equal weighting of four U.S. asset classes compounded at 13.7%; $100 grew to $17,300, without much additional risk.

One more important point these math-oriented people had no trouble grasping: the benefits of deferring (or better still, eliminating) taxes on their gains.

I’ll never know the full results of this presentation. But already it’s starting to change young lives.

- “I made a Roth IRA contribution today.” –K.C., sophomore

These budding engineers are likely to earn good money — and could someday become multimillionaires.

I’m very confident that if they save money and “follow the math,” they are likely to be able to retire earlier, have more money to spend and give in retirement, have more to eventually leave to heirs, and with more peace of mind every step of the way.

Not bad for a 90-minute presentation, if I do say so.

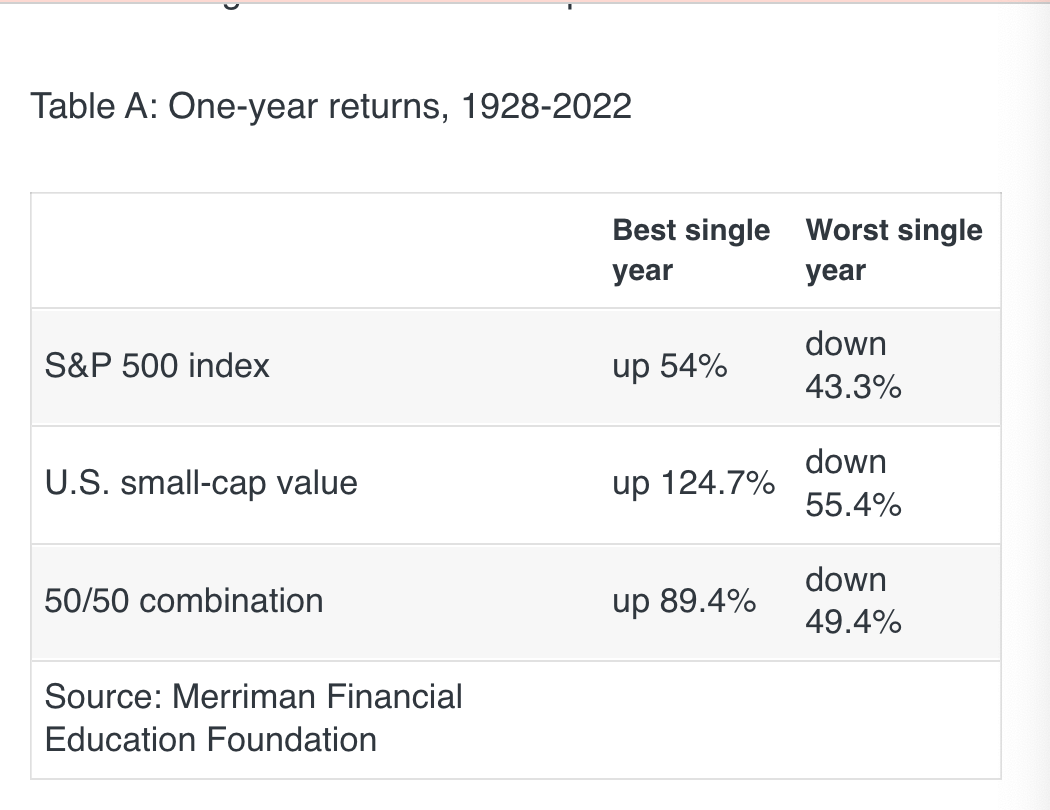

One year at a time, the results show a lot of variety. The difference between the best year and the worst year was much greater for small-cap value than for the S&P 500.

The third line shows the results of combining equal parts of those two asset classes.

As you’ll see in Table B, for investors who held on to one or both of these asset classes for 15 years, the variability of returns was much lower.

Table B: 15-year returns, 1928-2022

Table C is the real eye-opener among these three.

The worst 30-year periods in each case were positive. They were all reasonably productive. And the worst 30-year losses were remarkably close to each other.

Sure, there’s a difference between 8.4% and 8.8%. Over 30 years, an investment of $10,000 would grow to $112,429 at the lower rate vs. $125,564 at the higher rate. But that’s hardly a life-changing difference.

However, the differences between the best periods were considerably more dramatic.

A 30-year investment compounding at 13.7% (the S&P 500) would grow to $470,775. At 22.7% (small-cap value) the comparable result would be hard to believe: $4.63 million.

Still, not many investors would be willing to stick with an all-small-cap-value portfolio for 30 years. The 18.6% return of the 50/50 combination would be easier to stomach, and it would turn $10,000 into $1.67 million.

These tables illustrate a few lessons for investors.

- The variability of returns is much lower in longer periods;

- The differences between the best returns are usually greater than the differences between the worst returns.

- Combining the S&P 500 and small-cap value provided a smoother ride in one-year and 15-year periods and provided the highest 30-year return.

Here’s something else: Regardless of what time period you measure, small-cap value has been by far the most likely to be the top performer among the four major U.S. asset classes, which also include small-cap blend and large-cap value in addition to the S&P 500.

This supports my view that small-cap value can be a worthwhile addition to any long-term portfolio, even if it plays only a modest role.

I think there’s at least one more valuable lesson for all the colored dots in Figures 1 and 2 above.

The next time you hear someone predicting the stock market, remember: This year or next year, the S&P 500 has demonstrated that it could be up by more than 50% — or down by more than 40%.

Here are two pieces of data, covering all the calendar years from 1928 through 2022, that can help narrow that down a little.

- Two-thirds of the returns for the S&P 500 fell between minus 10% and plus 30%.

- Two-thirds of the returns for small-cap value stocks fell between minus 30% and plus 40%.

Want to know more about small-cap value investing? Check out my video “20 things you should know about small-cap value stocks.”

Delivery Method. Paul Merriman will send stories to MarketWatch editors on a biweekly basis. Licensor may republish such stories 24 hours after publication on MarketWatch with the attribution.