Our Mission: Empower Do-It-Yourself Investors with Free Academic-based Research & Resources for Life-long Investing

Saving for retirement is easier than you think

Reprinted courtesy of MarketWatch.com.

Published: April 23, 2025

To read the original article click here

Lots of people tell me they don’t see how they’ll ever be able to afford to retire. But it’s probably easier than they think as long as they get a few things right.

More than anything else, you’ve got to set money aside regularly, without fail. Even small regular savings can eventually add up to big money. And (of course) you have to invest that money where it will work hard for you.

This is the fifth in a series of articles I call Investor Boot Camp 2025. The series is designed to give you the most important information and tools you could get from a good financial adviser.

What follows is one of the most powerful lessons every investor should learn.

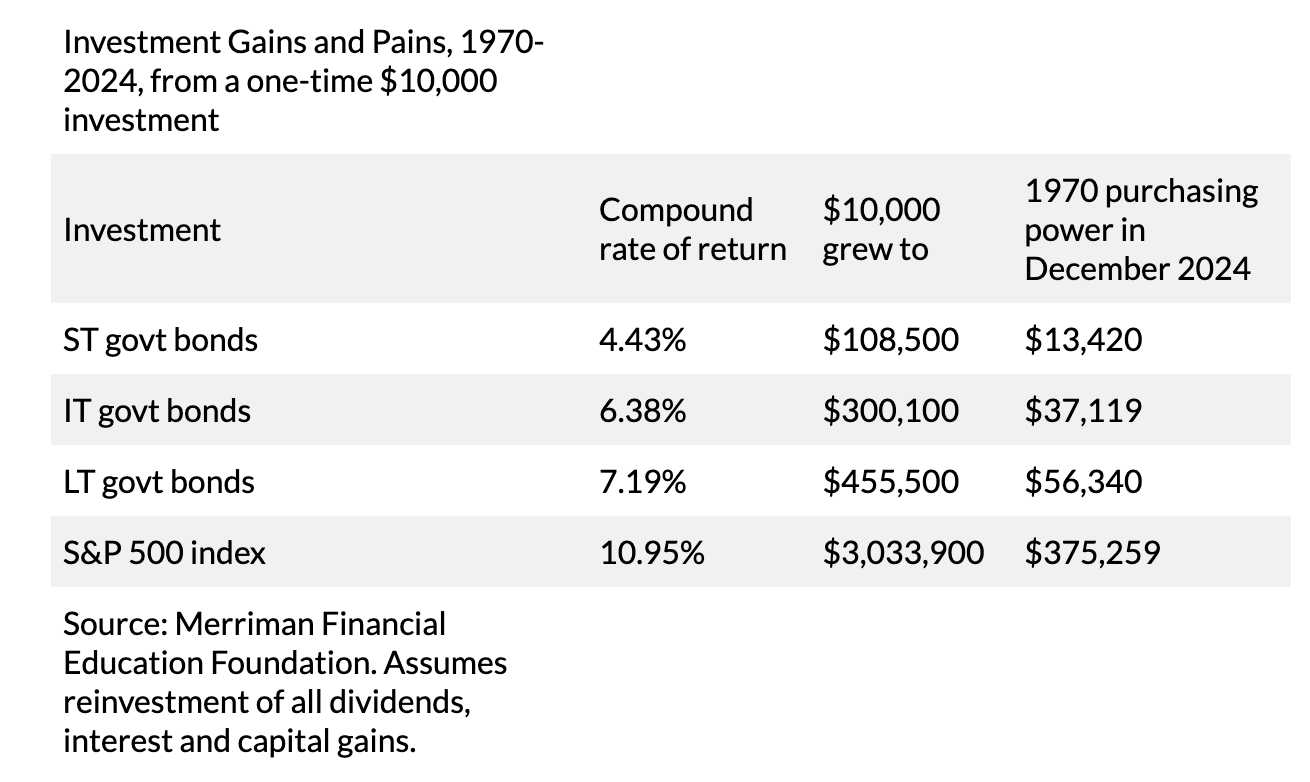

In the second installment of this series, I emphasized the importance of investing in stocks, not bonds, so your portfolio will experience what you need most: long-term growth.

In pursuing that growth, I can’t overemphasize how important it is to start early. Time — lots and lots of it — is your biggest ally.

Here are four action items for you right away.

- If you haven’t yet “gotten around to” starting a retirement savings program, do it now. Start this very week, using whatever money you have. It will feel good to be on your way.

- Make a commitment to keep at it with a plan you can afford.

- Get the long-term power of the stock market working for your savings right away.

- And find a way to make your savings automatic so you don’t have to think about it every month or every paycheck.

Before we get to the numbers, I’d like to suggest you think of your savings plan as if you were starting a business, along with a terrific business partner: the stock market.

Your job: Fund the business by regularly adding capital. Your partner’s job: Make that capital grow big enough so you can retire comfortably.

I’ll have a bit more to say about that. But let me show you what can happen from such a partnership.

We’ve put together a small table based on actual returns from the S&P 500 SPX +0.92% spanning the most recent 40 calendar years.The table assumes three things:

- In 1985, you had a job and started putting aside a little more than $20 a week – $88.33 a month to be exact, or $1,000 a year;

- You increased that amount by 3% every year;

- And you kept doing that through the end of 2024.

We consolidated those 40 years into five-year blocks. In each case, you can see how much you had contributed, how much your “partner” had contributed, and the end-of-year value of your account.

In the early years, most of the money came from you. But by the end of 15 years, your partner had added nearly $4 for every $1 of yours.

And once you got past the hump of 2000-2009, things got much, much better.

Although the numbers in the table reflect reality for someone who started in 1985, they do not reflect the effects of inflation. Nor, of course, do they predict future returns.

But they DO show how powerfully the market can multiply whatever amounts you contribute to your “business.”

How much should you save?

If you can set aside 10% of your earnings each year and invest that money intelligently, you’ll be well on your way toward a comfortable retirement.

If you’re fortunate enough to work for an employer that matches some part of your contributions in a retirement plan, you’ll do considerably better than this table suggests.

These figures cover 40 years, equivalent to a 25-year-old working until a retirement age of 65.

The “magic” in this scenario comes from doing what millions of people do all the time: They engage a willing and capable business partner (the market) in order to own stakes in hundreds (and in many cases thousands) of real-world companies.

Every business day, employees of those companies show up for work. Managers figure out how to profit from that work. Executives plot to make sure investors get a share of those profits.

Your job as the “senior partner” in this little business arrangement is to keep your focus on the big picture and the long term. If you do that and let your partner do its job, the long-term payoff can be huge.

Here’s more good news: You can get even more from this partnership.

In the table above, we defined the stock market as the S&P 500. If you’re willing to diversify by investing some of your retirement savings into other asset classes, your long-term results could be considerably more impressive.

In a future installment of Boot Camp 2025, we’ll look at how you can that.

My main point here is that even relatively modest savings can add up to big rewards when you are ready to retire.

Finally, here is another idea that always appeals to me. If you have a child or a grandchild who has many investing years ahead, you might consider adding some of your own “matching funds” to provide a boost in the early years.

Saving and investing for retirement is a big topic. To help you sort it out, I’ve recorded a podcast and a video in which I’ll walk you through the major points about saving money for retirement.

In the next two installments of this Boot Camp series, we’ll discuss some smart ways to take money out of your portfolio when you’re ready to retire.

Richard Buck contributed to this article.

Paul Merriman and Richard Buck are the authors of “We’re Talking Millions! 12 Simple Ways to Supercharge Your Retirement.”

Delivery Method. Paul Merriman will send stories to MarketWatch editors on a biweekly basis. Licensor may republish such stories 24 hours after publication on MarketWatch with the attribution.