Our Mission: Empower Do-It-Yourself Investors with Free Academic-based Research & Resources for Life-long Investing

How to retire with more money and greater peace of mind

Reprinted courtesy of MarketWatch.com

Published: July 21, 2025

To read the original article click here

Want to live it up in retirement and keep your peace of mind? And without worrying that you might run out of money?

If your answers are yes, read on. I’ll show you several ways to accomplish all that.

This is part of a series of articles I call Investor Boot Camp 2025. We’re going over the most important lessons you could likely get from a good financial adviser.

There’s one crucial element that’s up to you, a key that will unlock everything I’m going to describe here: Saving more than “just enough” before you retire.

To put the following strategy to work, you’ll need to be able to adjust your spending level to reflect what’s going on in the market. When things are going well, you get to spend more. When things are not going so well, you’ll need to tighten your belt a bit.

If you want your money to work harder for you, here’s another very important thing you should do: Diversify your equities beyond the S&P 500 SPX+0.14%.

In five relatively simple tables, you’re about to see what those two things can accomplish.

To make the numbers work, let’s start with a few assumptions:

- You retire with a relatively conservative portfolio of $1 million, 60% invested in equity funds, the rest in government bond funds.

- You begin your retirement on Jan. 1, 1970.

- In January (actually, on the last market day of 1969), you withdraw $40,000 to support yourself for your first 12 months of retirement.

- You know you can get by with less than $40,000 if you need to. You also would like to spend more if your investments do well.

- Every year at the end of December, you calculate the value of your portfolio and take out 4%.

I’m choosing the starting date of 1970 for two reasons. First, that coincides with a wealth of data for each year through 2024. Second, the 1970s included two significant challenges for investors: a nasty bear market and high inflation.

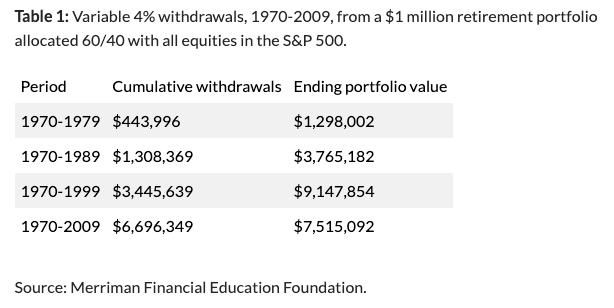

Table 1 below shows how your investments would have held up during retirement with the equity part (that’s 60%) invested exclusively in the S&P 500.

Each line highlights a different decade, showing how much money you had cumulatively taken out and how much your portfolio was worth at the end.

Right off the bat, these numbers tell us several interesting things. In the first 10 years, cumulative withdrawals averaged only slightly more than the $40,000 first-year payout. In a time of high inflation, that would have required a lot of serious belt-tightening.

In addition, you’ll see that after 30 years of retirement, you were in much better shape. And then along came the two severe bear markets of the early 21st century, leaving you a lot less money at the end of 2009 than you had 10 years earlier.

The good news is that there’s a cure for that: diversification in your equity funds.

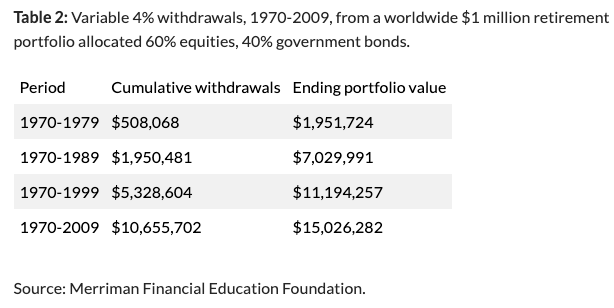

If you are an overachiever, you could build a 10-fund portfolio with massive worldwide diversification. This is what I have referred to in many past articles as the Ultimate Buy and Hold Strategy.

Here’s how that would have worked out.

Those numbers are vastly better than the ones in Table 1. But managing 10 equity funds isn’t necessary if your goal is to far outpace the S&P 500.

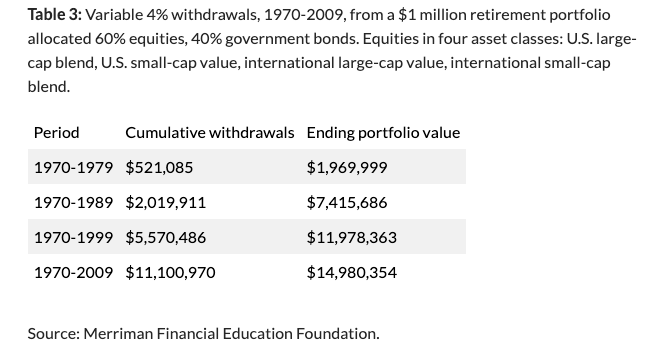

A much more practical alternative is a four-fund equity powerhouse that combines large and small, growth and value, U.S. and international.

With only four equity funds, this achieved essentially the same long-term result as from 10.

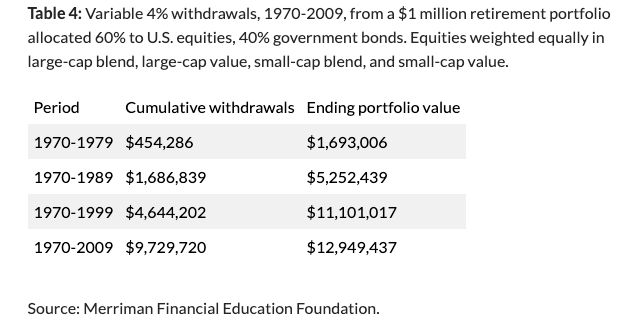

However, I understand many investors are uncomfortable owning foreign-based companies, even in U.S.-based funds.

So Table 4 shows a strategy with equal weighting in four U.S. asset classes: large-cap blend (the S&P 500), large-cap value, small-cap blend, and small-cap value.

Except for the cumulative withdrawals in the first 10 years, this was a big improvement over what we saw in Table 1.

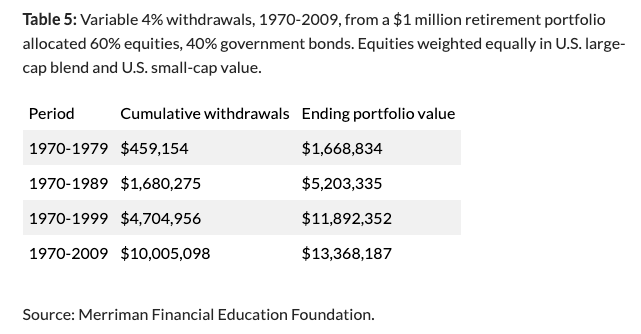

Finally, some adventurous investors may want to invest half their equity portfolio in small-cap value stocks while keeping the other half in the more comfortable S&P 500.

For them, we have a U.S. two-fund portfolio.

Even this relatively aggressive equity portfolio didn’t knock it out of the ballpark in the 1970s. But for retirees who lasted 30 years or longer, it certainly was a winner.

If the differences seem less dramatic than you might expect, remember: In every case except the one shown in Table 2, the majority of the portfolio was invested in government bonds and the S&P 500.

These five outcomes would have been different if the order of the decades had been swapped. If the returns of the 1980s and 1990s had occurred first, followed by those of the ‘70s and the first decade of this century, all the outcomes would have been more favorable.

This phenomenon is known as “sequence of returns,” and I’ll discuss in detail in a future article.

Meanwhile, if you’re looking for the best ETFs, check out my podcast on Avantis vs. DFA.

Richard Buck contributed to this article.

Delivery Method. Paul Merriman will send stories to MarketWatch editors on a biweekly basis. Licensor may republish such stories 24 hours after publication on MarketWatch with the attribution.