Are Vanguard ETFS really the best deal?

Reprinted courtesy of MarketWatch.com

Published: September 11, 2023

To read the original article click here

Every week I am asked about Vanguard and its funds. So in this article I’ll tackle six frequent questions, starting with the most popular.

Question 1: Which is the better ETF, the Vanguard Total Stock Market Index Fund VTI or the Vanguard 500 Index Fund VOO ?

Response: This can be confusing. At first glance, the total market value seems like it should be the obvious winner, as it includes some of the wide diversification that is almost universally recommended by investment experts.

But the long-term evidence does not necessarily support that view.

Hypothetical index returns from 1928 through 2022 show a compound return of 9.8% for the S&P 500 SPX and 9.7% for the total stock market.

From 1970 through 2022, the returns of the two indexes were virtually identical at 10.4%.

As with most investments, short-term comparisons show more differences. As of Aug. 28, VOO’s year-to-date return was 15.5%, VTI’s 14.8%.

Bottom line: Over the long haul, your choice between these funds is unlikely to make a huge difference.

Question 2: What is Vanguard’s best small-cap value ETF?

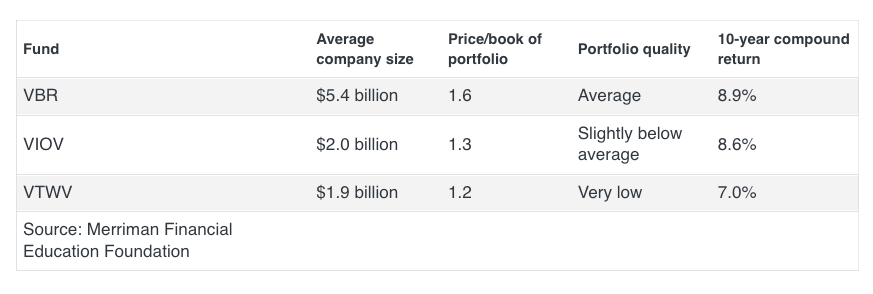

Response: Picking “the best” is tricky. The research can lead you down many byways. But if I had to choose one for the long haul, I’d go for the Vanguard S&P Small-Cap 600 Value ETF VIOV.

Among Vanguard’s small-cap value ETFs, VIOV most closely follows the findings of academic researchers who have identified the key characteristics of small-cap value stocks. It owns the best combination of companies with smaller capitalizations, lower prices relative to book value plus higher quality corporate fundamentals like cash flow and profits.

The table below shows those metrics for three Vanguard small-cap value funds. The price/book ratio measures how much an investor will pay per share for the company’s book value; a lower ratio indicates a more deeply discounted price.

If you have a brokerage account at Vanguard, you have access to many other small-cap value ETFs. Two with a lot of long-term potential are Avantis Small Cap Value AVUV and Dimensional Advisors Small Cap Value DFSV.

These are not index funds, and they’re newer than Vanguard’s entries. But their managers methodically concentrate on quality fundamentals.

Question 3: If I have the choice between a target-date fund at Vanguard or Fidelity, which is better?

Response: As long as you stick with Fidelity’s index target-date funds (instead of its actively managed ones), I think neither choice is bad — and I don’t have a financial relationship with either Vanguard or Fidelity.

Their equity portfolios are very similar. And yet there are important differences.

Start with expenses: Vanguard charges 0.08% annually vs. Fidelity’s 0.12%. Vanguard’s lower cost means higher returns for shareholders.

Vanguard’s glide path, while it’s similar to Fidelity’s, gives retirees age 80 and up 10% more equities (30%), compared with 20% at Fidelity. That is likely to be beneficial for older retirees, though of course that outcome is not certain.

Here’s another big difference: Fidelity takes significantly more interest-rate risk with its fixed-income portfolio. When the bond market started to crash in 2022, Fidelity’s bond funds had much longer maturities, and returns suffered.

In the end, Vanguard wins my vote.

Question 4: Will I do better to just skip the target-date funds and do this on my own?

Response: Maybe, maybe not.

It depends on how much work and time you’re willing to put into designing and maintaining your portfolio. Neither is a huge task. But if you take shortcuts or neglect either one, you’re unlikely to get the results you desire.

As a DIY investor, you can eliminate one of the key weaknesses of target-date funds: the fact that investors younger than age 40 wind up holding about 10% of their portfolios in fixed-income funds.

If you start investing when you’re 20 and skip the fixed-income funds until you’re 45, you could wind up with 30% more money over your lifetime.

Question 5: If I choose to do this on my own, can I improve on Vanguard’s equity model?

Response: Yes.

Target-date funds typically hold 40% of their equities in companies based outside the United States.

However, these international holdings are predominantly large-cap blend funds that often move up and down in near lockstep with the S&P 500 and have similar long-term returns.

As a DIY investor, you could instead diversify away from U.S. large-cap blend stocks by owning small-cap value stocks, which move up and down at different times and rates and have produced an average annualized return of 2 to 3 percentage points higher than the S&P 500 during the last 53 years.

When you’re in charge of the allocation, you can hold as much (perhaps 50% if you’re aggressive) or as little (5% if you’re timid) as you like. That’s likely to give you a much greater long-term benefit than you would get from owning international large-cap blend stocks.

Question 6: You have high praise for Vanguard and its funds. But I notice you recommend other ETFs. Are they really better than Vanguard’s?

Response: Yes.

For investors committed to Vanguard’s low-cost funds, we have identified 13 Vanguard ETFs worth recommending.

You can put them together in many ways, as we have done in our Sound Investing Portfolios.

For investors who aren’t wedded to Vanguard, we’ve found good alternatives using a rigorous methodology that’s explained in this video and in this article.

We call these the Best in Class ETFs, and although they are more expensive than Vanguard’s, we believe they are likely to pay investors a premium that will more than offset the additional cost.

These ETFs are available commission-free at Vanguard’s brokerage arm.

In the three years ending Aug. 15, 2023, our Vanguard recommendations had average returns of 8.1%. In that same three years, the comparable Best in Class ETFs had average returns of 10.9%.

I know that a three-year period doesn’t prove much. But that performance is the result of thousands of hours of work, and I don’t believe the outcome is random.

Richard Buck contributed to this article.

Paul Merriman and Richard Buck are the authors of “We’re Talking Millions! 12 Simple Ways to Supercharge Your Retirement.” Get your free copy.

Delivery Method. Paul Merriman will send stories to MarketWatch editors on a biweekly basis. Licensor may republish such stories 24 hours after publication on MarketWatch with the attribution.

The Merriman Financial Education Foundation is a registered 501(c)(3) organization founded in 2012.

All donations are used to support our work. Deductions are permissible to the extent of the law.

Contact us at info@paulmerriman.com

All information on this site is provided free of charge (with the exception of books for sale) and is funded in full by The Merriman Financial Education Foundation.

Anyone wishing to use this educational information in web-based or printed materials are welcome to do so with the following attribution and link:

“This information freely provided courtesy of PaulMerriman.com.” We would also appreciate a copy and link of where it has been published via email.

All Rights Reserved